arizona real estate tax records

Find Arizona Property Records. Public Property Records provide information on.

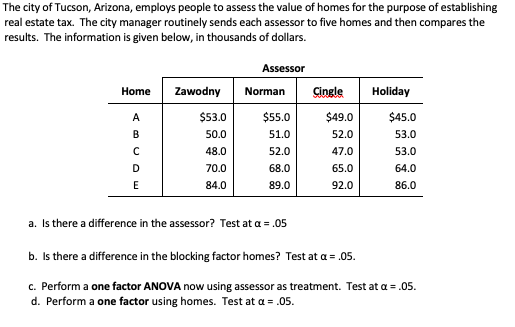

Solved The City Of Tucson Arizona Employs People To Assess Chegg Com

Enter only the first eight numbers of your parcel followed by the alpha letter if one exists.

. Pursuant to Arizona Revised Statute 42-18151. Relationship Between Property Values Taxes Prior to the. If it is a person.

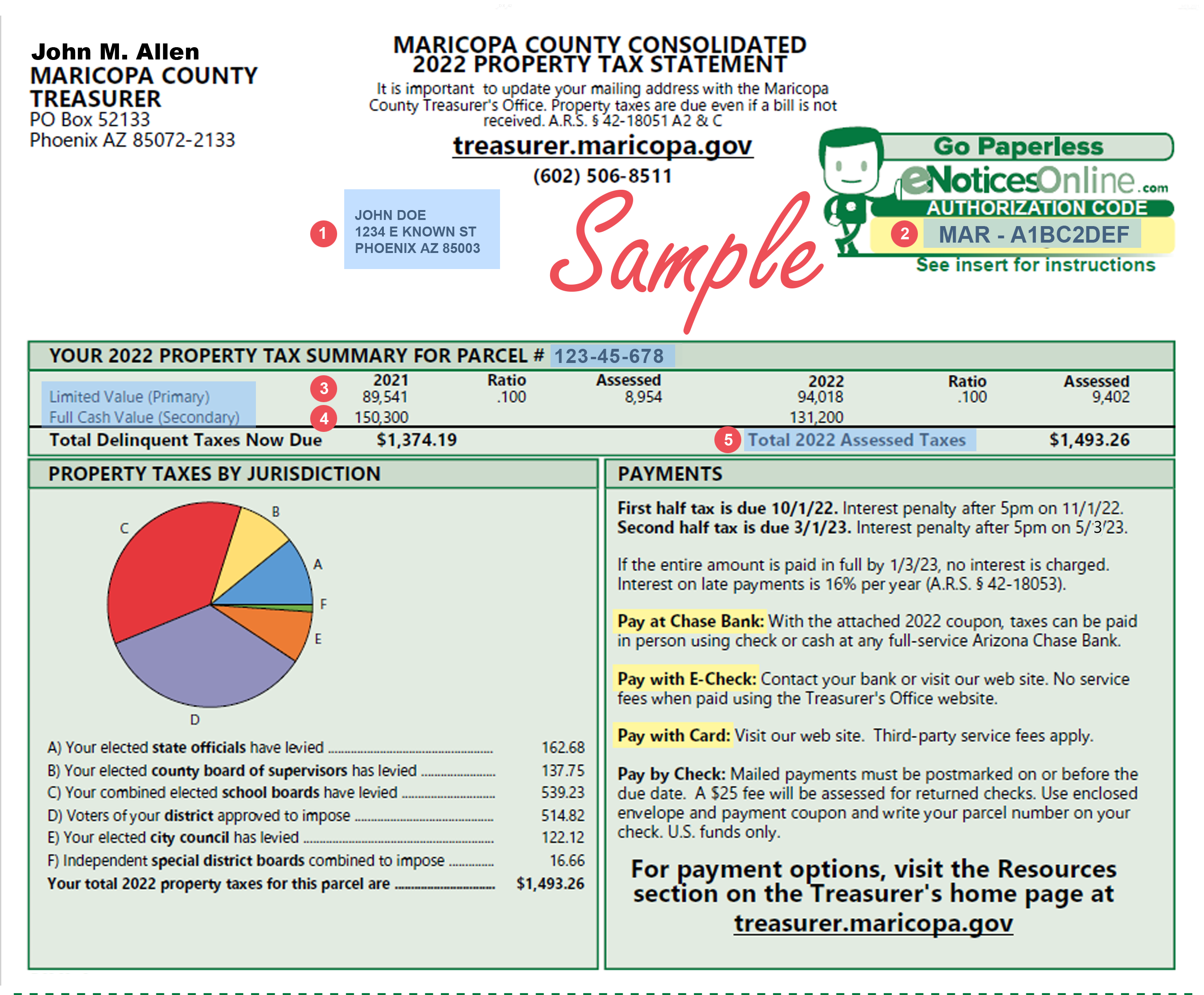

Maricopa County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Maricopa County Arizona. The LPV of 116424 would be multiplied by 10 to reach the AV of 11642. Maricopa County Property Records are real estate documents that contain information related to real property in Maricopa County Arizona.

See Property Records Tax Titles Owner Info More. By the end of September 2021 Pima County will mail approximately 455000 property tax bills for the various property taxing jurisdictions within the County. Ad Get In-Depth Property Tax Data In Minutes.

Please use Last Name First Name format in your search. Ad Type In A Name State To Search Tax Lien Property Records Tax Evasion Records More. Ad Get In-Depth Property Tax Data In Minutes.

To calculate property taxes paid. Start Your Homeowner Search Today. Use our free Arizona property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and.

Search Graham County property tax and assessment records by parcel number book and map address owner name or tax ID. We created this site to help you to. All records matching your criteria will be returned.

Explanation of Parcel Number. Public Property Records provide information on land. Start Your Homeowner Search Today.

Taxation of real property must. A Arizona Property Records Search locates real estate documents related to property in AZ. Assessor Graham County Assessor General Services Building.

Tax Records include property tax assessments property appraisals and income tax records. Annually the tax rate is calculated based on the tax levy for each taxing authority and assessed values by the County Assessor. Search Any Address 2.

Certain Tax Records are considered public record which means they are available to the. 1 be equal and uniform 2 be based on present market value 3 have a single appraised value and 4 be deemed taxable unless specially exempted. The alpha letter can be upper or lower case.

Compiled from Arizona public property. Primary and secondary property taxes would then be paid on every 100 of this AV. Arizona real estate investors can leverage PropertySharks exhaustive Arizona real estate records for any property from residential to commercial.

The last ninth digit and dashes are not necessary to. If you dont have that number enter your last name as it appears on your tax bill or enter just your house number and street name without any directional or suffix. Free Arizona Property Tax Records Search.

The Assessor annually notices and administers over 18 million real and personal property parcelsaccounts with a full cash value of more than 717 billion in 2022 Search. Any person that wants to pay on behalf. The Arizona property tax system is administered jointly by the Arizona Department of Revenue Department and the 15 county assessors and treasurers.

Certain Tax Records are considered public record which means they are available to the. Ad Type In A Name State To Search Tax Lien Property Records Tax Evasion Records More. A real property tax lien that is sold under article 3 of this chapter may be redeemed by.

See Property Records Tax Titles Owner Info More. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the taxpayer. Find Arizona residential property tax records including land real property tax assessments appraisals tax payments exemptions.

Search Any Address 2. Tax Records include property tax assessments property appraisals and income tax records.

2022 Property Taxes By State Report Propertyshark

Phoenix Property Tax Consultants Ke Andrews Maricopa County Appeals

.jpg)

Pay Property Taxes Online County Of Mohave Papergov

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Does Arizona Have A Real Estate Transfer Tax The Arizona Report

Arizona Prop 130 Disabled Vets Could Get Property Tax Exemptions

Cost Of Living Value Sun City Arizona The Original Fun City

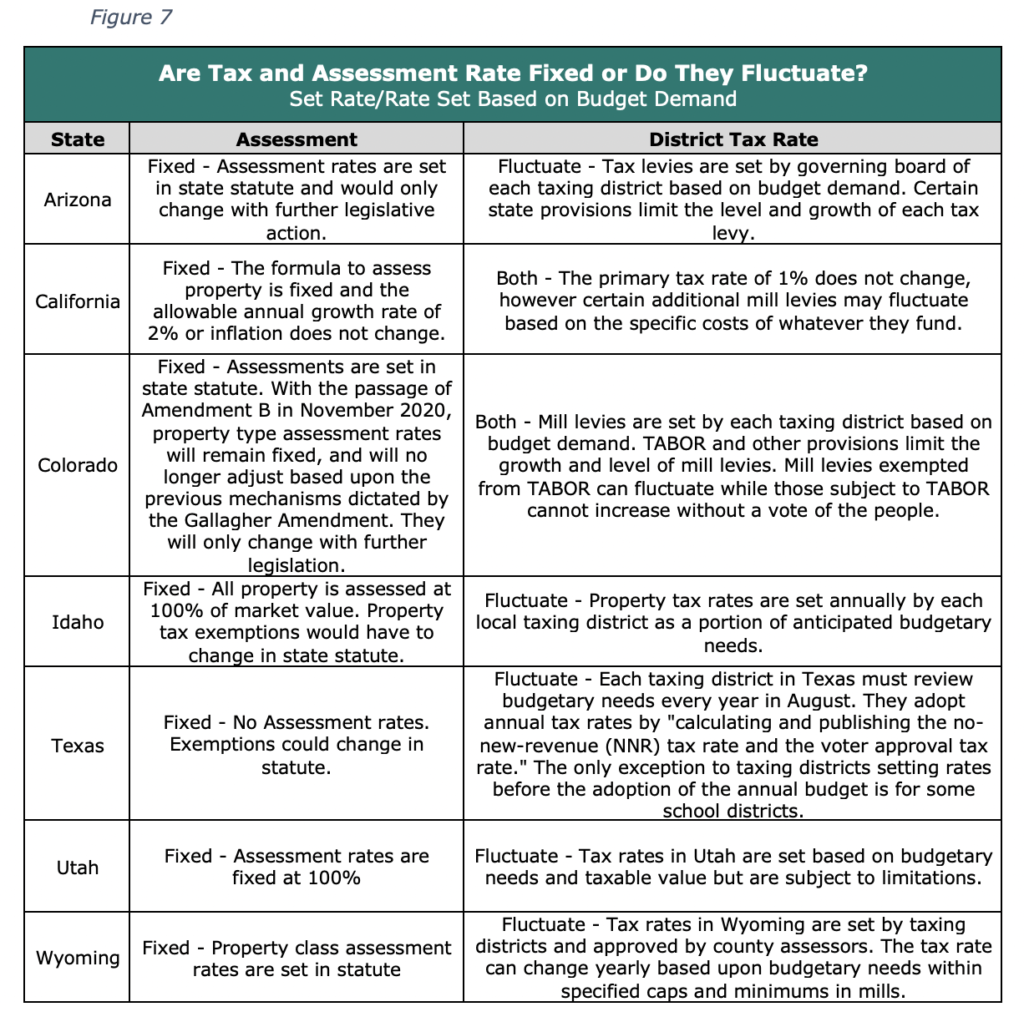

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Solved The City Of Tucson Arizona Employs People To Assess Chegg Com

Property Tax Calculator Estimator For Real Estate And Homes

Arizona Assessor And Property Tax Records Search Directory

Real Estate And Tax Data Search Fond Du Lac County

Maricopa County Assessor S Office

Tangible Personal Property State Tangible Personal Property Taxes